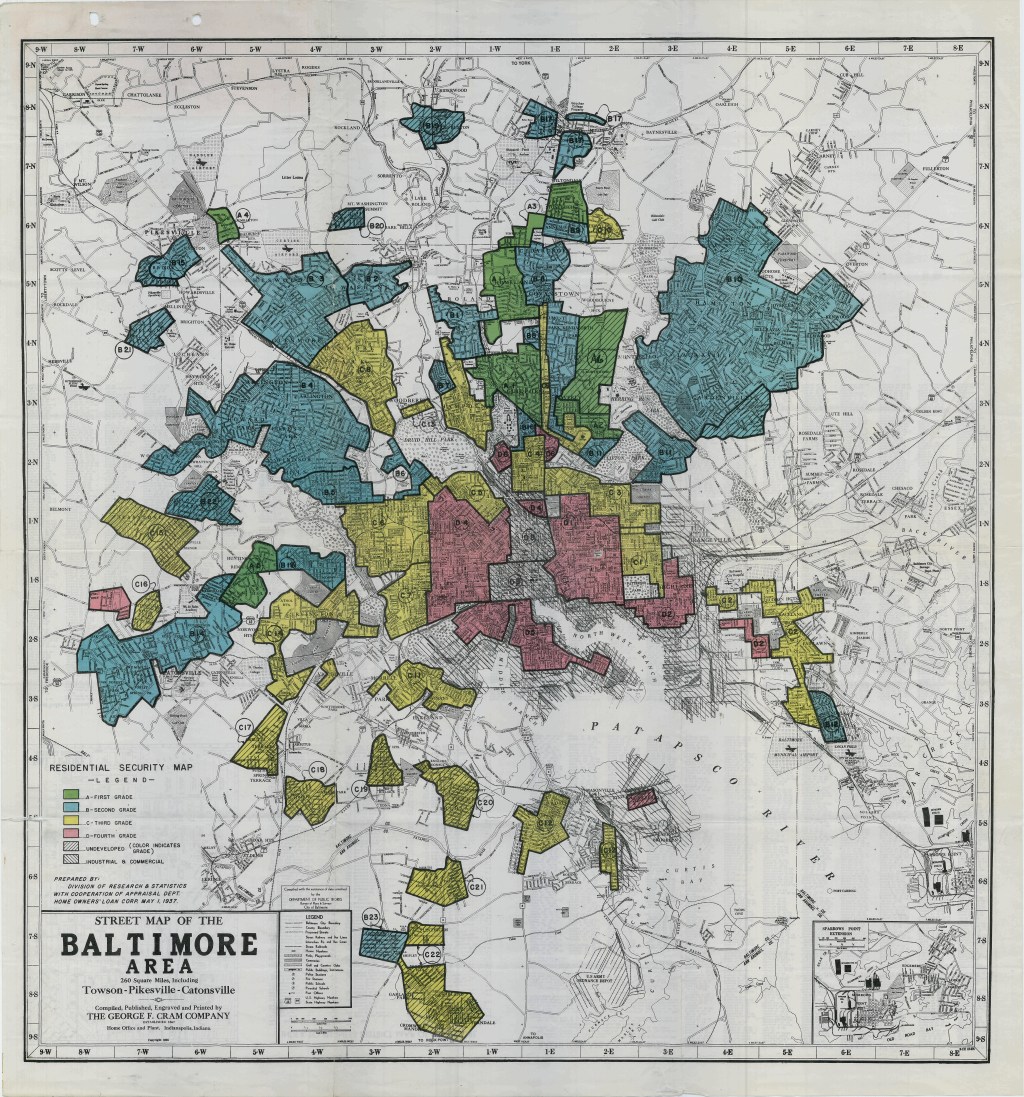

Maryland has been at the forefront of redlining practices since 1910, when Baltimore became the first American city to enact housing segregation laws.[1] While the legal practice of redlining is a relic of the past, its lingering effects are deeply embedded in Maryland.[2] Governor Wes Moore has defined redlining as “one of the greatest wealth thefts in our state’s history.”[3] Historically, mortgage lenders unfairly denied loans to people in certain areas, especially in central city neighborhoods and communities with large Black populations.[4] This practice meant people were shut out of credit opportunities even if they were financially qualified.[5]

Although redlining was outlawed in 1968 by the Fair Housing Act,[6] its effects continue to negatively impact home ownership, house values, credit scores, and even life expectancy for Black communities.[7] Home values are consistently lower in rural areas and predominantly minority neighborhoods, including: Baltimore City, Prince George’s County, Southern and Western Maryland, and the Eastern Shore.[8] Notably, areas with over 80% minority residents face greater challenges.[9] Housing recovery from the Great Recession has lagged significantly in these communities compared to majority white areas.[10] Additionally, people of color encounter more hurdles securing loans and refinancing mortgages.[11] For example, in 2021, Black applicants faced denial rates double those of white applicants.[12]

In October 2021, the U.S. Department of Justice (“DOJ”) announced the creation of a new task force to combat redlining.[13] The task force is responsible for ensuring fair lending enforcement, partnering with financial regulatory agencies to streamline the identification and referral of suspected violations to the DOJ, and working more closely with State Attorneys General to identify and address potential violations.[14] In the same year, the Maryland General Assembly enacted S. 859/H.D. 1239, creating the Appraisal Gap From Historic Redlining Financial Assistance Program (“the Program”).[15] This Program, administered by the Department of Housing and Community Development (“DHCD”), offers financial assistance to affordable housing developers working in low-income census tracts. The Program also addresses appraisal gaps, which occur when the construction cost of a property exceeds its appraised value.[16] Assistance from the Program is distributed on a first-come basis and places a limit of $500,000 for eligible construction expenses.[17]

In 2023, the General Assembly amended the Program to provide financial assistance to more individuals and communities that have been systemically disadvantaged in the housing market.[18] The 2023 alterations expanded financial assistance, allowing for more types of financial aid to be offered to help close the gap between the appraised value and the purchase price of a home.[19] Additional changes included: modifying the eligibility requirements for projects that receive financial assistance, extending the timeframe during which applications for the Program can be submitted, and eliminating certain limitations on the amount of financial assistance provided.[20]

Maryland is taking important steps to reverse the lasting effects of redlining and invest in communities that have been most impacted.[21] In addition to the Program enacted in 2021, the DHCD also launched the Homeownership Works program. In December of 2023, Governor Wes Moore announced the Utilizing Progressive Landing Investments to Finance Transformation (“UPLIFT”) Program, aimed at increasing homeownership in historically redlined communities.[22]

Addressing racial disparities in homeownership requires a comprehensive strategy.[23] No one-size-fits-all solution exists, as these biases are firmly ingrained in the housing system, both on national and local levels.[24] The effects of redlining run deep in Maryland and without continued intervention, the wealth gap for people of color will inevitably grow.[25]

[1] Gretchen Boger, The Meaning of Neighborhood in the Modern City: Baltimore’s Residential Segregation Ordinances, 1910-1913, 35 J. Urb. Hist. 236, 236 (2009).

[2] Univ. of Md. Nat’l Ctr. for Smart Growth et al., Examining Racial Disparities in Maryland’s Housing Market, Md. Dep’t. of Hous. & Cmty. Dev. (Dec. 2022), https://dhcd.maryland.gov/Documents/ExaminingRacialDisparitiesMarylandsHousingMarket.pdf.

[3] Marc. H. Morial, MORIAL: Wes Moore’s Efforts to End Racial Gap Earn Him the NUL President’s Award, Wash. Informer (Nov. 15, 2023), https://www.washingtoninformer.com/racial-wealth-gap-maryland-gov-wes-moore/.

[4] Jonathan Rose, Redlining, Fed. Rsrv. Hist. (June 2, 2023), federalreservehistory.org/essays/redlining.

[5] Id.

[6] Rose, supra note 2.

[7] Shuo Jim Huang & Neil Jay Sehgal, Association of Historic Redlining and Present-Day Health in Baltimore, PLOS One, Jan. 19, 2022, at 1, https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0261028.

[8] Maggie Haslam, UMD Report Reveals Racial Disparities in Owning, Financing a Home in Maryland, Md. Today (Mar. 6, 2023), https://today.umd.edu/umd-report-reveals-racial-disparities-in-owning-financing-a-home-in-maryland.

[9] Id.

[10] Id.

[11] Id.

[12] Id.

[13] Press Release, U.S. Dep’t. of Just., Justice Department Announces New Initiative to Combat Redlining (Oct. 22, 2021), https://www.justice.gov/opa/pr/justice-department-announces-new-initiative-combat-redlining.

[14] Id.

[15] Act of May 30, 2021, 2021 Md. Sess. Laws, ch. 702 (enacted under Md. Const. art. II, § 17(c)). See S. 859, 2021 Gen. Assemb., 442nd Sess. (Md. 2021); see H.D. 1239, 2021 Gen. Assemb., 442nd Sess. (Md. 2021).

[16] Id.

[17] Id.

[18] Act of May 29, 2022, 2023 Md. Sess. Laws, ch. 707 (enacted under Md. Const. art. II, § 17(c)). See S. 445 2023 Gen Assemb., 445th Sess. (Md. 2023); see H.D. 625, 2023 Gen Assemb., 445th Sess. (Md. 2023).

[19] Id.

[20] Id.

[21] UPLIFT, Md. Dep’t. of Hous. & Cmty. Dev. https://dhcd.maryland.gov/HousingDevelopment/Pages/UPLIFT.aspx (last visited Mar. 3, 2024).

[22] Id.

[23] Haslam, supra note 8.

[24] Id.

[25] Id.

Sienna Duran-Kneip is a second-year J.D. Candidate at the University of Baltimore School of Law and the incoming Comments Editor for Law Forum. Sienna graduated from Chapman University in 2019 with a double major in Economics and Spanish, and a minor in Italian Studies. She works as a Paralegal at Kreindler & Kreindler, LLP, specializing in September 11th Victim Compensation Fund claims. Last summer, Sienna interned with Human Rights First. This summer she will be interning with the U.S. Agency for International Development in Washington, D.C.. At UB, Sienna works as a Research Assistant for Professor Nienke Grossman and Teaching Assistant for the Introduction to Trial Advocacy 1L class. She also serves as the incoming Vice President of the International Law Society, incoming Vice President of the Latin American Law Student Association, and is a member of the Jessup International Law Moot Court team. Upon completion of her J.D., Sienna plans to continue her legal education abroad, pursuing an LLM in international human rights law.

**The Image displayed in this Hot Topic is a scanned map courtesy of “Mapping Inequality,” from the Digital Scholarship Lab at the University of Richmond.**

Leave a comment